Buying a house has traditionally been our preferred choice for accommodation. A self-owned house gives a sense of security and stability and most importantly an asset that can be leveraged in personal economic troubles. Nevertheless, the recent slump in the real estate sector has experts suggesting a behavioral shift of preference from buying a house to renting one. Some of them are also arguing that renting a house makes more economic sense than buying. One of the key arguments used against buying is the interest component of the EMI for financing a house, which is higher than the monthly rent for renting. Since real estate prices are already at a record high and interest rates in India haven’t decreased as much as its global peers, financing a house becomes a costly affair. And for most of the houses, the interest of the first few months of EMIs is usually more than the rent. However, comparing the interest component of the first few EMIs with the monthly rent is unfair. Because interest charges decrease over time as the loan matures and principal is paid, while rent naturally increases due to inflation. So this argument is valid for the first few months and possibly some initial years but not after a few years when the rent would have increased and interest would have decreased. Hence a better indicator would be to compare the total interest paid during the period against the total rent paid.

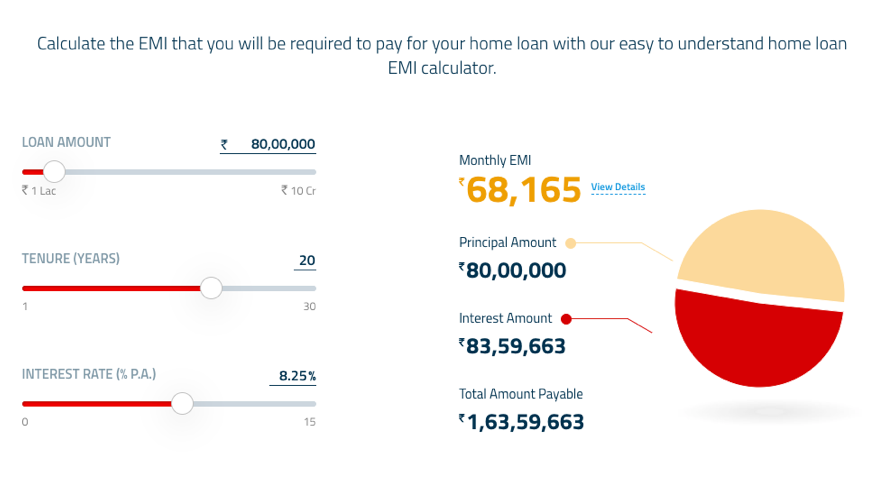

Let’s consider a 1 BHK flat in suburban Mumbai, which typically costs Rs 1Cr. to buy and approximately 30-35K per month to rent. To buy this flat, assuming the buyer arranges for a housing loan for 80% of the total value at 8.25% per annum interest for twenty years, the monthly EMI would be Rs 68K and the total interest paid over the term of the loan will be Rs 84Lac (refer the calculations which I have taken from the HDFC website). If we compare the first month EMI’s interest component(Rs 55k) with the first month’s rent(Rs 30k), the former admittedly is higher. But if we look at the total rent paid for twenty years for this house with a 4% annual rent increment, it becomes Rs 1.1Cr., which is much larger than the total interest to be paid. Moreover, renting doesn’t create an asset, while buying creates an appreciating asset. If we include the capital appreciation of the property in our consideration, it would further bolster the argument in favor of buying.

Notwithstanding this conclusion, the real estate sector is not the investment destination it used to be a few years back. Millennials prefer renting over buying. This lack of demand for houses can be attributed to factors like some recent developments in this sector, structural changes in our economy and changes in behavioral preferences. Some of these factors are

- Drying up of credit in real estate- Due to a record high outstanding housing loans and an increase in NPAs, banks and NBFCs have implemented stricter norms to sanction loans. The availability of financing is limited only to a stable income group of people with strong credit scores.

- Unattractive returns on residential properties over the last decade have pushed investors away from real estate. Housing was the most favorite investment destination to park surplus funds by individuals. But due to the negative yield housing sector has given in recent times, mutual funds and open market investments have taken that investment space.

- Lack of trust in builders has affected the under-construction properties and hence under construction inventories have soared up in cities. Many home buyers were duped by builders and the delivery of houses was deferred endlessly. As a result, buyers now prefer ready to move apartments over under-construction properties and builders have themselves to blame for trust deficit.

- GST and Demo impacting parallel cash economy- like it or not but we cannot ignore the contribution of India’s parallel economy to GDP. The government’s push to bring them to formal channels and weed out corruption through GST and Demonetisation has hit the shadow economy which was instrumental in creating demand for houses.

- An increasing migrant population working in the private sector prefers renting over buying because it’s more convenient. It gives the flexibility to move from one place to another and explore better job prospects.

- Job insecurity and lack of confidence over a long term stable earnings are also a major cause of why people are reluctant to make a long term commitment. Renting gives them a better option to choose a lifestyle that suits their present income.

- And finally, the skyrocketing prices of real estate have also contributed to this slump. Real estate prices had soared to a record high before the slump, according to a survey by NHB(National Housing Bank), housing prices in India increased by 125% between the year 2011 and 2016. While the average per capita income increased by just 32% during that period, the affordability of houses decreased significantly over this period.

The real estate sector is a major contributor to the country’s GDP and one would hope that the slowdown ends sooner than later. However, with the global economy entering into a low growth phase (and possibly a recession in the near term) this may take longer than anticipated. Property prices along with housing rents have further been affected by this slowdown. But for those who need a permanent roof and more importantly those who can afford to buy one, there was never a better opportunity than now. Resale houses are the safest option in the current market, but near possession properties could also be looked upon as they give more value for money. And those who are not sure about buying yet can keep on renting and enjoy the flexibility it offers.

JOE

June 19, 2023 at 5:45 amthank youi